Here’s your home-buying checklist

Buying a home is probably the biggest purchase most of us will make in our lifetimes. It’s perfectly natural to have questions and experience every known emotion during the home-buying process.

There’s a lot of work to do, but don’t worry — this home-buying checklist will help you roll up your sleeves and get you ready for your closing date in 10 easy steps.

Home-buying checklist

- Home buying checklist

- Check your finances

- Down payment

- Mortgage pre-approval

- Finding an agent

- House hunting

- Making an offer

- Home inspection and appraisal

- Final mortgage approval

- Closing Process

- Get started

Complete the home-buying checklist

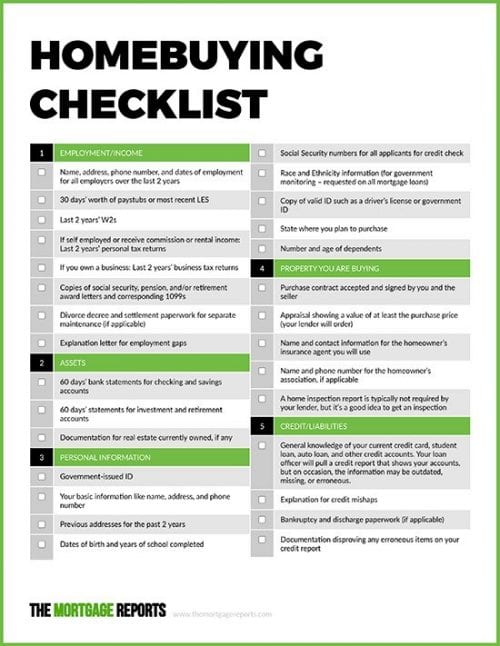

Use this home-buying checklist as a cheat sheet for your entire home-buying process: from gathering your documents to applying for a mortgage and finding your dream home. We explain each stage of the process in detail below.

Click the image to open a PDF version of the home-buying checklist.

1. Figure out what you can afford

Homeownership can be among the biggest financial decisions that you’ll make. Before you begin visiting open houses, be sure you can afford the purchase price of your dream home.

Most home buyers will need a loan to buy a new house, which requires finding a lender. There’s nothing worse when you’re buying a home than having your mortgage application denied. So checking your finances before you begin house hunting is an important first step.

Use a mortgage calculator

A mortgage affordability calculator can help both first-time home buyers and seasoned veterans understand:

- How much house you can afford

- Desired loan terms and interest rates

- Down payment amount

- Desired monthly mortgage payments

- Estimated property taxes

Take some time to consider how your current monthly expenses compare with the results of your mortgage calculator estimates.

Check your credit score

Your credit score is an important factor in qualifying for a mortgage and determining the interest rate on your home loan.

Even if you have good credit, double-check your credit report and contest any errors.

Paying down any high-interest credit card debt, personal loans, or student loans before applying for a mortgage can also help increase your credit score and lower your debt-to-income ratio.

2. Arrange the down payment

Once you’ve figured out how much home you can afford, the next step is determining how much of a down payment you’ll need.Check your mortgage eligibility.

The size of your down payment is largely determined by the type of mortgage you get. Down payments on conventional mortgages begin around 3% to 5% of the home’s purchase price.

However, if you want to avoid private mortgage insurance, you’ll need 20% down.

FHA loans require 3.5% down, and some types of loans allow you to buy a house with no down payment at all. Government-backed USDA and VA loans let you finance 100% of the home price with no money down.

Regardless of the size of your down payment, it’s a good idea to put aside a little extra to cover closing costs and any repairs that your home inspection might reveal.

3. Settle on a lender and get pre-approved

Most people take their time with the house-hunting phase when buying their dream home. The average home-buying process in the U.S. takes about four months.

During the shopping period, you’ll learn what is and is not important to you for a new home in your price range, which neighborhoods you prefer, and what your deal-breakers are. Verify your home-buying eligibility. Start here

However, few home buyers enjoy the mortgage process as much as house shopping.

The majority surveyed by the Consumer Financial Protection Bureau (CFPB) only considered a single mortgage lender when financing their property. In addition, a significant percentage put off contacting a lender at all until after they found the perfect home.

Mortgage pre-approval

You really shouldn’t begin shopping for a house until you know how much house you can afford. And if you want sellers and their real estate agents to take you seriously, you need a pre-approval letter.

Keep in mind that pre-approval is not the same as pre-qualification. When you get pre-qualified by a lender, it’s an estimation of what they’ll lend you.

Pre-approval is a more rigorous examination of your financial situation, and it lets you know exactly the loan amount a lender is willing to underwrite.

- You get pre-approved for a home loan by applying to one or more mortgage lenders. Underwriters will likely have questions or lists of documents they want, and once you comply with their requests, you get your pre-approval letter

- The CFPB survey found that almost every borrower considered the interest rate or loan costs as primary considerations when shopping for mortgage lenders. It’s easy to request a fist full of quotes online, so get them now. Then, you can contact several of the most competitive lenders and evaluate them personally

- Note the mortgage lenders whose style of working meshes with your own. If you prefer calls and get texts, or if your loan officer is hard-to-find when you have questions, choose someone who makes you more comfortable

4. Find a real estate agent

A real estate agent can be a huge help when buying a home. Not only can agents find homes for sale as soon as they’re listed, but agents know the housing market in your area and can provide unique insights that will help you find the perfect home. Connect with a lender to start your mortgage pre-approval

When finding a real estate agent, ask friends and family for recommendations, read online reviews, and be sure to speak with several options before deciding on the agent that’s right for you.

In addition, home buyers shouldn’t worry about the cost of a real estate agent.

Many first-time home buyers don’t know this, but the seller almost always pays their agent and the buyer’s agent. So you can usually get help from a buyer’s agent free of charge.

5. Look for your dream home

Once you know exactly how much you can spend, and that you’ll be able to buy any property that meets your lender’s standards, the fun begins. Go shopping. This is the fun part of the home-buying checklist, too.

This checklist below was created by HUD, and it does a good job of reminding you to pay attention to the same details for each house you see. As you complete the forms and see more houses, you and your agent should quickly learn what areas and home types are better fits.

Use one for each house you tour, and match it up with any pictures you take. Alternatively, several house-shopping apps allow you to integrate your notes and pics into online files. For every criterion, note if the home feature is a good, average, or poor fit for you.

House hunting checklist:

Home

- Square footage

- Number of bedrooms

- Number of baths

- Practicality of floor plan

- Interior walls condition

- Closet/storage space

- Basement

- Fireplace

- Cable TV

- Basement: dampness or odors

- Exterior appearance, condition

- Lawn/yard space

- Fence Patio or deck

- Garage

- Energy efficiency

- Screens, storm windows

- Roof: age and condition

- Gutters and downspouts

Neighborhood

- Appearance/condition of nearby homes/businesses

- Traffic

- Noise level

- Safety

- Security

- Age mix of inhabitants

- Number of children

- Pet Restrictions

- Parking

- Zoning regulations

- Neighborhood restrictions/ covenants

- Fire protection

- Police

- Snow removal

- Garbage service

Schools

- Age/condition

- Reputation

- Quality of teachers

- Achievement test scores

- Play areas

- Curriculum Class size

- Busing distance

Convenience

- Supermarket

- Schools

- Work

- Shopping

- Child care

- Hospitals

- Doctor/dentist

- Recreation/parks

- Restaurants/Entertainment

- Church/synagogue

- Airport

- Highways

- Public transportation

6. Hire a real estate lawyer (if required)

Hiring a real estate lawyer isn’t always a necessity, but some states require an attorney to represent you. Your agent or realtor can tell you if one is needed.

If your state does require a real estate attorney, avoid choosing the cheapest service you can find. Treat this process similar to how you would select a lender or an agent — get recommendations, read reviews, and speak with several options before deciding.

7. Make an offer and negotiate

When you’ve found the perfect home, it’s time to make an offer. Your real estate agent or Realtor will guide you through the process, and in many cases, take the lead.

Your offer will be based on numerous factors, including

- How hot the real estate market is

- Asking price

- Whether or not there are other offers

- How long the property has been on the market

The seller will either accept, decline, or counter your purchase offer. If the seller declines, you have the option to make a counteroffer.

Your purchase offer will include an earnest money deposit — typically between 1% to 3% of the purchase price — that will be put into escrow. The earnest money will remain in escrow until the seller accepts your offer.

If you get cold feet about the home and rescind your offer, the earnest money is forfeited to the seller. Otherwise, it will be applied to your down payment and mortgage closing costs.

8. Get final approval on your mortgage

Once the seller has accepted your offer, you’ll begin the formal mortgage application process.

Even though you’ve been pre-approved for a loan, expect to provide additional documentation to your loan officer as the underwriting process progresses.

Documents you’ll need for the mortgage application

Mortgage lenders simply want to make sure that you can afford your home loan and that you are likely to repay it as agreed. They must comply with government regulations requiring them to prove that they have evaluated you lawfully.

Employment and income verification

- Pay stubs covering one month or most recent Leave and Earnings Statement from the military

- Last two years’ W2s

- If self-employed, a commissioned employee (25% percent or higher), or an employee with unreimbursed business expenses or real estate income, you’ll supply at least your last two tax returns. For income that is highly variable or unusual, you may need additional years

- If you own a business, you need at least two years of business tax returns

- Proof of receipt for Social Security, pension, public assistance (if used to qualify), or other income. This usually means an award letter, check stub, or direct deposit

- Divorce decree and settlement paperwork for separate maintenance (if applicable)

- Explanation letter for employment gaps

Assets

- Two months’ bank statements for checking and savings accounts

- Two months’ statements for investment and retirement accounts

- Information for real estate already owned (use, income, if it’s on the market, estimated value, mortgages)

Personal information

- Government-issued ID

- Previous addresses for the past two years

- Dates of birth and years of school completed

- Social Security numbers for all applicants

- Race and Ethnicity information (for government monitoring – requested on all mortgage loans)

- State and county in which you plan to purchase

- Number and age of any dependents

Property details

- Purchase contract accepted and signed by you and the seller (if you have one picked out)

- Name and contact information for the homeowner’s insurance agent you will use

- Name and phone number for the homeowner’s association, if applicable

Credit and liabilities

- Your loan officer will check your credit score by pulling a credit report that shows your accounts, but on occasion, the information may be outdated, missing, or erroneous. That information is incorporated into your mortgage application, and you’re responsible for its review and confirmation

- Explanation for credit score mishaps

- Divorce decree and settlement paperwork for child or spousal support expenses (if applicable)

- Bankruptcy and discharge paperwork (if applicable)

- Documentation disproving any erroneous items on your credit report

Don’t forget homeowners insurance

Your lender may require you to get homeowners insurance as part of the approval process. Even if they do not, it’s a good time to get quotes from your insurance company, or shop your homeowners insurance policy around with a few providers to get the best deal on coverage.

9. Schedule a home inspection and appraisal

After you’ve reached an agreement with the seller on the purchase price of the home, the next step is scheduling the home inspection and appraisal.

The home inspection will ensure the property is up to code and that the foundation and roof are structurally sound. Your home inspector will test systems like plumbing and electrical and provide you with a detailed report with the home inspection results.

In addition to a basic inspection, some home buyers also test for the presence of radon and mold.

While a home inspection is not required, it’s highly recommended and helps you avoid any hidden problems that might affect your home value in years to come.

A home appraisal, on the other hand, will be required by your mortgage lender to confirm that the home value is consistent with the loan amount.

Your appraiser will determine the market value of the home by looking at property values in the neighborhood and evaluating the home’s general condition.

10. Close on your new home

Congratulations, the closing process is the final step to homeownership! Your real estate agent and loan officer will take care of most of the work, but you will have a few final tasks — including signing mountains of paperwork.

- Your lender provides the closing disclosure at least three days before closing

- Final walk-through of the property on or before closing

- You’ll bring a certified check or scheduled wire transfer to cover your down payment and closing costs

- You’ll also need proof of homeowners insurance

- Identification

Are you ready to get started?

Once you’ve studied the home buying checklist, you’re ready to get the ball rolling.

Start with an overview of today’s mortgage rates to find out what you can afford